BlockProf

Paper Moon, Bill of Rights, Boring Side of Crypto

It is Only a Paper Moon

It is only a paper moon

Sailin' over a cardboard sea

But it wouldn't be make believe

If you believed in me…

-By Yip Harland and Billy Rose, sung by Frank Sinatra

You may have seen the news this week that the algorithmic stablecoin Terra and its associated token Luna blew up and eviscerated tens of billions of wealth overnight. I was never one of the “Lunatics” that pumped Luna and claimed it would go “to the moon.” I did buy into the Mars Bank protocol on Terra because I liked the lending design. So I did take a hit, I was right about the lending protocol but didn’t pay enough attention to the impact of stablecoin de-peg on the protocol, but you live and learn.

I won’t join the post-mortem further, and I won’t join the shaky-kneed who promise to get out of crypto altogether. Or the “I told you crypto is risky” sermons that have come off as smug, and even worse, imprecise. (Plus this week was a great week to buy some bargains).

Many projects in DeFi for example still offer fundamental promise to cut out the Wall Street middleman, or even better allow those of us who provide liquidity as retail LPs to collect fees for it as the middleman… and that requires stablecoins. MKR/Dai has shown it is a more robust model under market stress than uncollateralized stablecoins.

Many in crypto are suspicious of the alternative centralized/collateralized stablecoin model, as they fear the government can always shut it down. Maybe you can have it both ways though…imagine USDC being wrapped or deposited for another token on the Secret Network, a privacy chain that is expected to have its own DeFi protocols. We’ll see.

It is still a risky and evolving technology. Sam Bankman-Fried’s critique of some DeFi projects, that they seem to be about "putting money in the box, getting a token, then putting the token back in the box for another token,” and how that model is unsustainable, rings true for some projects.

But enough about DeFi and stablecoins. I don’t think we spend enough time talking about the boring crypto projects. More on that in a second. First, on to the situation in DC and the new Digital Asset User Bill of Rights.

The Washington Merry Go Round

DC politicians can’t stop comparing the Luna meltdown and the broader crypto bear market to 2008. That’s an unfair comparison for many reasons. First, crypto hasn’t brought the broader economy down with it (more like the other way around).

And Luna’s meltdown, while contributing to a market wide dip this week, has yet to lead to a Lehman domino effect within crypto. Plus, we crypto investors aren’t getting any bailout anytime soon. The irony is, we may get a 2010 Dodd-Frank style regulatory blowback stick without the 2008 candy big bank bailout.

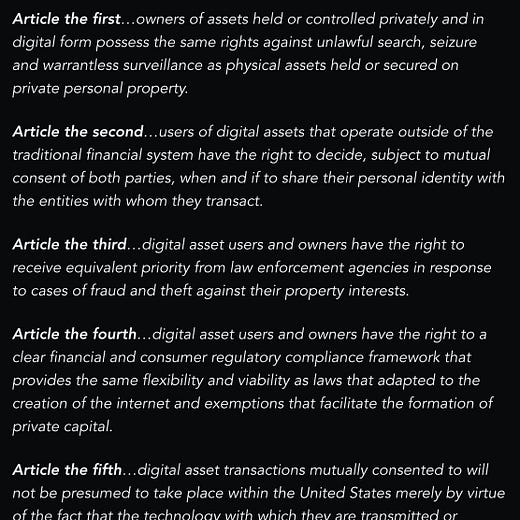

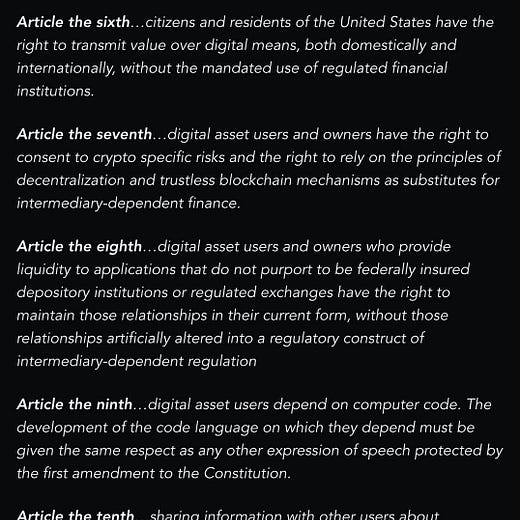

Here’s a line in the sand I’ve drawn with my Messari colleague Ryan Selkis in the Digital Asset User Bill of Rights.

Here’s the latest from Messari with more on the path ahead, and what crypto can do to self-regulate:

The Boring Side of Crypto

I’m tired of hearing about monkey pictures. I want to focus on the boring side of crypto. And by boring, I don’t actually mean boring. I mean less flashy, less pizazz, but from a financial analysis perspective quite exciting. Warrent Buffett’s favorite investments in the early days of Bershire were things he described as boring but lucrative, like railroads, bridges, tunnels. Infrastructure with steady revenue.

Since late last year one of my primary focuses has been on Web3 infrastructure.

I can’t learn enough about projects like Helium for example. Replacing 5G is only one of the projects new ambitions. The oversimplified description is that we own our own mini cell towers that make the system work for applications from the Internet of Things to 5G to other applications across the telecom landscape.

Easier said than down to get a network to that kind of critical mass, but retail users have 3 million of them on back order to keep building the network so they are off to a great start. Plus it’s one of Anthony “The Mooch” Scaramucci’s favorite crypto investments.

My Messari colleague Sami Kassab has a great report out about Helium this weekend, just in time to help us all focus on the “boring” side of crypto:

Take a look at more useful insights on crypto web3 and decentralized file storage infrastructure projects that are earning steady and growing revenue. These are some of my favorite investments (How did I find these? I read Messari, how else?)

If you want to live a long, happy and prosperous life, stop following the crypto twitter shills. Instead read these reports, and read the collected work of Carla Reyes on things like securitization applications for blockchain technology and how crypto can replace provisions of the UCC.

Read more about the emerging field of digital identity and blockchain applications for it. (I still don’t understand why people still sign pdfs, contract lawyers and judges remain in a massive pretend game that this offers any verification of identity).

And cancel your subscription to podcasts and youtube videos that talk about trading chart candle gobbledy-gook, and instead hone your mind with in depth technical and legal discussions with my friends at The Encrypted Economy podcast.

Love to my readers, ya’ll are the best. (We hit 1,200 this week!)

Without your love

It's a honky-tonk parade

Without your love

It's a melody played in a penny arcade

It's a Barnum and Bailey world

Just as phoney as it can be

But it wouldn't be make believe

If you believed in me